35+ Debt calculator with extra payments

Before deciding to pay off a debt early. Being wary fits into your overall debt reduction plan of calculating cutting and curbing.

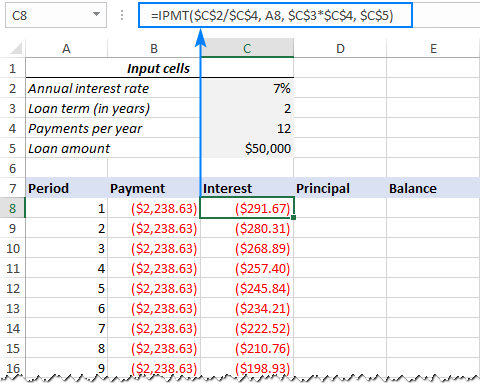

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

The extra payment calculator allows you to enter the following figures.

. In contrast if you. Enter your current balance along with the APR your normal. By making a small additional monthly payment toward principal you can greatly accelerate the term of the loan and thereby realize tremendous savings in interest payments.

Early Loan Payoff Calculator. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Our calculator can help you estimate when youll pay off your credit card debt or other debt such as auto loans student loans or personal loans and how much youll need to pay each.

Calculate the amount of money you can set aside each month. Calculate monthly payments on a loan try different loan scenarios for affordability or payoff and calculate the payments months or principal remaining. Should I rent or buy a home.

Check out our debt calculator extra payment selection for the very best in unique or custom handmade pieces from our shops. Should I convert to a bi-weekly. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

This calculator shows how much interest you can save by making extra debt payments. Use our extra payment calculator to determine how much more quickly you may be able to pay off your debt. Loan amount total principal of the loan stated on the contract Extra payment per month how much you plan to.

This calculator shows how long it will take to payoff 35000 in debt. Check out our debt calculator extra payment selection for the very best in unique or custom handmade pieces from our shops. Then use this Debt Reduction Calculator.

Conforming fixed-rate estimated monthly. Making extra payments of 500 month could save. Comparing mortgage terms ie.

Loan calculator with extra payments. Original loan balance Annual percentage rate 0 to 40 Initial term in months. The Debt Payoff Calculator above can accommodate a one-time extra payment or multiple periodic extra payments either separately or combined.

15 20 30 year Should I pay discount points for a lower interest rate. Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments. If you use the debt snowball method without any extra monthly payments it will take you 55 months to pay off both debts with a total monthly payment of 79763.

You can make extra payments each month or set a desire payoff year. It can be used for any loan credit card debt student debt personal business car house etc.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

1

Couples In Quarantine Only 18 Are Satisfied With Their Communication During Coronavirus Pandemic

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

35 Ways To Save Money Fast On A Low Income We Saved 30 000 Saving Money Best Money Saving Tips Ways To Save Money

35 Ways To Save Money Fast On A Low Income We Saved 30 000 Saving Money Best Money Saving Tips Ways To Save Money

Saving Gas Money In Face Of Gas Price Rises Energy Blog

How To Save Money With Your Boyfriend Random Assets Of Life Saving Money Couple Finances Financial Planning Dave Ramsey

1

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

1

35 Ways To Save Money Fast On A Low Income We Saved 30 000 Saving Money Best Money Saving Tips Ways To Save Money

Formalbest Of Self Employed Tax Deductions Worksheet Check More At Https Www K Business Tax Deductions Small Business Tax Deductions Monthly Budget Template

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

1